Exam III: Risk Management Frameworks . Operational Risk . Credit Risk . Counterparty Risk . Market Risk . ALM . FTP - 2015 Edition 온라인 연습

최종 업데이트 시간: 2025년10월27일

당신은 온라인 연습 문제를 통해 PRMIA 8008 시험지식에 대해 자신이 어떻게 알고 있는지 파악한 후 시험 참가 신청 여부를 결정할 수 있다.

시험을 100% 합격하고 시험 준비 시간을 35% 절약하기를 바라며 8008 덤프 (최신 실제 시험 문제)를 사용 선택하여 현재 최신 362개의 시험 문제와 답을 포함하십시오.

정답:

Explanation:

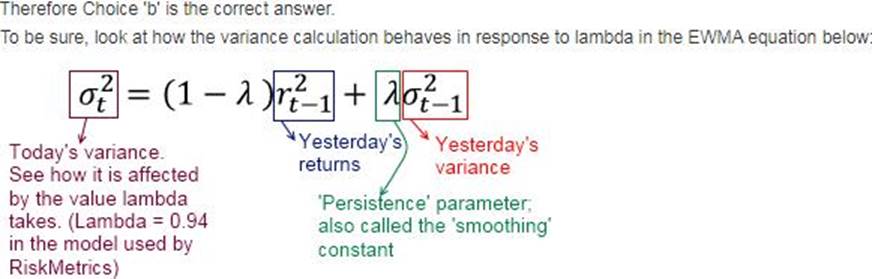

The persistence parameter, , is the coefficient of the prior day's variance in EWMA

calculations. A higher value of the persistence parameter tends to 'persist' the prior value of variance for longer. Consider an extreme example - if the persistence parameter is equal to 1, the variance under EWMA will never change in response to returns.

1 - is the coefficient of recent market returns. As is lowered, 1 - increases, giving a greater weight to recent market returns or shocks. Therefore, as is lowered, the model will react faster to market shocks and give higher weights to recent returns, and at the same time reduce the weight on prior variance which will tend to persist for a shorter period.

정답:

Explanation:

Ex-ante VaR calculations can differ from actual realized P&L due to a large number of reasons. I, II and III represent some of them. Mean reversion however has nothing to do with VaR estimates differing from actual P&L. Therefore Choice 'c' is the correct answer.

정답:

Explanation:

All the listed variables are relevant to management monitoring the credit risk profile of an institution, therefore Choice 'd' is the correct answer.

정답:

Explanation:

Credit VaR is the difference between the expected value of the portfolio and the value of the portfolio at the given confidence level. Therefore the credit VaR is $85m - $ 60m = $25m. Choice 'b' is the correct answer.

Note that economic capital and credit VaR are identical at a risk horizon of one year. Therefore if the question asks for economic capital, the answer would be the same. [Again, an alternative way to look at this is to consider the explanation given in III.B.6.2.2: Credit Var = Q(L) - EL where Q(L) is the total loss at a given confidence interval, and EL is the expected loss. In this case Q(L) - $100-$60 = $40, and EL = $100-$85=$15. Therefore Credit VaR = $40-$15=$25.]

정답:

Explanation:

Statement I is correct as credit VaR calculations often use a one year time horizon. This is primarily because the cycle in respect of credit related activities, such as loan loss reviews, accounting cycles for borrowers etc last a year.

Statement II is false. There are two ways in which loss assessments in respect of credit risk can be made: default mode, where losses are considered only in respect of default, and no losses are recognized in respect of the deterioration of the creditworthiness of the borrower (which is often expressed through a credit rating transition matrix); and the mark-to-market mode, where losses due to both defaults and credit quality are considered. The default mode is used for the loan book where the institution has lent moneys and generally intends to hold the loan on its books till maturity. The mark to market mode is used for traded securities which are not held to maturity, or are held only for trading.

Statement III is correct. The confidence interval, or the quintile of losses used for maintaining credit ratings tends to be very high as the possibility of the institution's default needs to be remote.

Statement IV is correct too, for the reasons explained earlier.

정답:

Explanation:

The credit risk horizon for credit VaR is generally one year. Therefore Choice 'b' is the correct answer.

정답:

Explanation:

In the Standardized Approach, banks’ activities are divided into eight business lines: corporate finance, trading & sales, retail banking, commercial banking, payment & settlement, agency services, asset management, and retail brokerage. Therefore Choice 'c' is the correct answer.

정답:

Explanation:

Statement I is true as expected losses are the 'cost of doing business' and charged against the P&L of the unit holding the exposure. When evaluating the business unit, expected losses are taken into account. Unexpected losses however require risk capital reserves to be maintained against them.

Statement II is not true. Credit portfolio loss distributions are not symmetrical, in fact they are highly skewed and have heavy tails.

Statement III is true. The notional, or the face value of a defaulted debt is the basis for a claim in bankruptcy court, and not the market value.

Statement IV is false. In the case of over the counter instruments, the replacement value of the contract represents the amount of the claim, and not the notional amount (which can be very high!).

정답:

Explanation:

Three parameters define economic credit capital: the risk horizon, ie the time horizon over which the risk is being assessed; the confidence level, ie the quintile of the loss distribution; and the definition of credit losses, ie whether mark-to-market losses are considered in addition to default-only losses. The probability of default is not a parameter within the control of the risk manager, but an input into the capital calculation process that he has to estimate. Therefore Choice 'c' is the correct answer.

정답:

Explanation:

Parametric VaR relies upon reducing a portfolio's positions to risk factors, and estimating the first order changes in portfolio values from each of the risk factors. This is called the delta approximation approach. Risk factors include stock index values, or the PV01 for interest rate products, or volatility for options. This approach can be quite accurate and computationally efficient if the portfolio comprises products whose value behaves linearly to changes in risk factors. This includes long and short positions in equities, commodities and the like.

However, where non-linear products such as options are involved and large moves in the risk factors are anticipated, a delta approximation based valuation may not give accurate results, and the VaR may be misstated. Therefore in such situations parametric VaR is not advised (unless it is extended to include second and third level sensitivities which can bring its own share of problems).

Parametric VaR also assumes that the returns of risk factors are normally distributed - an assumption that is violated in times of market stress. So if it is known that the risk factor returns are not normally distributed, it is not advisable to use parametric VaR.

정답:

Explanation:

Losses due to credit risk include the loss of value from credit migration and default events (which can be considered a migration to the 'default' category). Therefore Choice 'd' is the correct answer. Changes in spreads or interest rates are examples of market risk events. [Discussion: It may be argued that losses from spreads changing could be categorized as credit risk and not market risk. The distinction between credit and market risk is never really watertight.

The reason I have called it market risk in this question is because spreads can change due to two reasons: first, due to the individual issuer going down in their credit rating (whether issued or perceived, as we have witnessed in Europe sovereign debt), and second due to the spread for the overall category changing due to macro fundamentals with nothing changing for the individual issuer. For example the spread between municipal bonds and treasuries may be small during boom times and may expand during recessions - regardless of how the individual issuer has been doing. Clearly, the first case is credit risk and the second is probably market risk.

A change in overall corporate bond spreads is something I would consider akin to a rate change - which is why I have called it as not a part of credit risk. But an alternative perspective may not be incorrect either.]

정답:

Explanation:

Delta is non-linear with respect to prices for a number of securities such as bonds, options and other derivatives. It changes with changes in prices, and any hedge initially undertaken becomes quickly mismatched. Therefore delta hedges need to be managed quite actively and kept up-to-date. Therefore I is true. Primary risks comprise most of the risk in a position, and therefore portfolio managers are right to focus on them over secondary risks. Therefore II is true. The greater the hedge rebalance frequency, the lower is the hedge mismatch at any point in time, and therefore residual risks would be lower. However, rebalancing hedges requires rebalance trades to be done, and these involve transaction costs. Generally, a reasonable balance needs to be struck between the frequency of

rebalances (a lower frequency increases residual risk, but this residual risk is not directionally biased) and the costs of rebalancing. III is correct. Vega risk is the risk arising due to changes in prices due to changes in volatility. Options carry vega risk. Therefore any hedges against vega risks can only be obtained using other options positions. (Vega risk may also be hedged using other volatility based products, eg an OTC volatility swap, or a VIX futures type product.)

정답:

Explanation:

When calculating volatility weighted VaR, returns are adjusted by a factor equal to the current volatility divided by the historical volatility, ie the volatility that existed during the time period the returns were earned. If the current volatility is greater than the historical volatility (also called contemporary volatility), then it has the effect of increasing the magnitude of any past returns (whether positive or negative). This in turn increases the VaR.

Consider an example: if the current volatility is 2%, and a return of -5% was earned at a time when the volatility was 0.8%, then the volatility weighted return would be 12.5% (=-5% x 2%/0.8%). Clearly, this has the effect of increasing the VaR. Choice 'd' is therefore the correct answer.

정답:

Explanation:

One way to think about this question is this: we are provided with two pieces of information: if the portfolio is worth $100 to start with, it will be worth $95 at the end of year 1 and $85 at the end of year 2.

What it is asking for is the probability of default in year 2, for the debts that have survived year 1. This probability is $10/$95 = 10.53%. Choice 'b' is the correct answer.

Note that marginal probabilities of default are the probabilities for default for a given period, conditional on survival till the end of the previous period. Cumulative probabilities of default are probabilities of default by a point in time, regardless of when the default occurs. If the marginal probabilities of default for periods 1, 2... n are p1, p2...pn, then cumulative probability of default can be calculated as Cn = 1 - (1 - p1)(1-p2)...(1-pn). For this question, we can calculate the probability of default for year 2 as [1 - (1 - 5%)(1 - 10.53%)] = 15%.

정답:

Explanation:

It is important to note the difference between sensitivity analysis and stress testing. Sensitivity analysis applies to measuring the effect of changes on the outputs of a model by varying the inputs - generally one input at a time.

In scenario analysis, a number of variables may be changed at the same time to see the impact on the dependent variable. For example, a bank may measure the changes in the value of its mortgage portfolio by varying its assumptions on prepayment expectations, interest rates and other factors, using its modeling software or application. The changes in the inputs may or may not relate to integrated real world situations that may arise. Sensitivity analysis is purely a quantitative exercise, much like calculating the delta of a portfolio.

A stress test may include shocks or large changes to input parameters but it does so as part of a larger stress testing programme that generally considers the interaction of risk factors, past scenarios etc. At its simplest, a stress test may be no different from a sensitivity analysis exercise, but that is generally not what is considered a stress test at large financial institutions.

A stress test may consider multiple scenarios, for example one scenario may include the events witnessed during the Asian crisis, another may include the events of the recent credit crisis. Simulation generally refers to a Monte Carlo or historical simulation, and is often a more limited exercise.

The exercise described in the question is the closest to a scenario analysis, therefore Choice 'c' is the correct answer.

It is important to note that all of the choices referred to in this question are related to each other, and the boundaries between them tend to be fuzzy. At what point does a complex sensitivity analysis start resembling a scenario, or a stress test can always be debatable, but such a debate would be more about the symantics than be of any practical use.