AICPA CPA Regulation 온라인 연습

최종 업데이트 시간: 2025년10월05일

당신은 온라인 연습 문제를 통해 AICPA CPA-Regulation 시험지식에 대해 자신이 어떻게 알고 있는지 파악한 후 시험 참가 신청 여부를 결정할 수 있다.

시험을 100% 합격하고 시험 준비 시간을 35% 절약하기를 바라며 CPA-Regulation 덤프 (최신 실제 시험 문제)를 사용 선택하여 현재 최신 69개의 시험 문제와 답을 포함하십시오.

정답:

Explanation:

Choice "c" is correct. Generally, the fair market value of prizes and awards is taxable income. However, an exclusion from income for certain prizes and awards applies where the winner is selected for the award without entering into a contest (i.e., without any action on their part) and then assigns the award directly to a governmental unit or charitable organization. Therefore, conditions "I" and "II" must be met in order for Ken to exclude the award from his gross income. Choice "a" is incorrect. "II" is a necessary condition as well. See explanation above.

Choice "b" is incorrect. "I" is a necessary condition as well. See explanation above.

Choice "d" is incorrect. "I" and "II" are both necessary conditions. See explanation above.

정답:

Explanation:

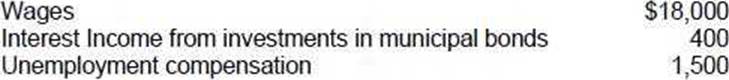

Choice "c" is correct. The wages of $18,000 and unemployment compensation are both includable in gross income on Adler's 2001 income tax return.

Choice "a" is incorrect. The unemployment compensation must be included in gross income.

Choice "b" is incorrect. Municipal bond interest income is excluded from gross income and the unemployment compensation must be included in gross income.

Choice "d" is incorrect. Municipal bond interest income is excluded from gross income.

정답:

Explanation:

Choice "c" is correct. Guaranteed payments are reasonable compensation paid to a partner for services rendered (or use of capital) without regard to his ratio of income. Earned compensation is subject to selfemployment tax. Payments not guaranteed are merely another way to distribute partnership profits. The ordinary income reported from an S corporation are taxable income to the individual or their own individual tax return but is not subject to self-employment tax. The ordinary income reported from a partnership may be subject to self-employment tax (if to a general partner).

정답:

Explanation:

Choice "b" is correct. Alimony would be income to Mary while child support would not. Funds qualify as child support only if 1) a specific amount is fixed or is contingent on the child's status (e.g., reaching a certain age), 2) it is paid solely for the support of minor children, and 3) it is payable by decree, instrument or agreement. The actual use of the funds is irrelevant to the issue. In this case, $2,000 (20% × $10,000) qualifies as child support. The other $8,000 is alimony, which would be income to Mary.

Choice "a" is incorrect. Take 80% of the $10,000 paid, not 80% of the $7,000 received by Mary. Choice "c" is incorrect. Only $8,000 would be alimony per the divorce decree (80% × $10,000). Choice "d" is incorrect. The 20% reduction when the child turns 18 makes 20% of the $10,000 payment, or $2,000, child support, which is nontaxable to Mary.

정답:

Explanation:

Choice "d" is correct. There is no income tax on the value of inherited property. The gain on the sale is the difference between the sales price of $4,500 and Hall's basis. Hall's basis is the alternate valuation elected by the executor. This is the value 6 months after date of death or date distributed if before 6 months. The property was distributed 4 months after death and the value that day ($4,500) is used for the basis. $4,500 − $4,500 = 0.

Choice "a" is incorrect. There is no income tax on the value of inherited property.

Choice "b" is incorrect. This is the basis of the stock if the alternate date had not been used. Heirs are not taxed on inheritances. The income or loss results when inherited property is sold.

Choice "c" is incorrect. There is no income tax on the value of inherited property. The gain on the sale is the difference between the sales price of $4,500 and Hall's basis. Hall's basis is the alternate valuation elected by the executor.

정답:

Explanation:

Choice "b" is correct. Prepaid interest must be prorated over the time for which payment is made. This is true for both cash and accrual basis taxpayers. The loan is for 1 month in 1992 and 11 months in 1993. Therefore, 1/12 of the interest is deductible in 1992 and 11/12, or $11,000 is deductible in 1993.

Choices "a", "c", and "d" are incorrect. Prepaid interest must be prorated over the time for which payment is made. This is true for both cash and accrual basis taxpayers.

정답:

Explanation:

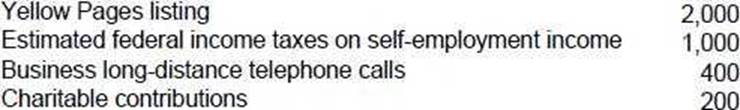

Choice "a" is correct. Deductions to arrive at net self-employed income include all necessary and ordinary expenses connected with the business. Estimated federal income tax payments are not an expense. Charitable contributions by an individual are only deductible as an itemized deduction on Schedule A. This assumes the contribution was not made with the "expectation of commensurate financial return."

Choice "b" is incorrect. Charitable contributions are an itemized deduction unless there is an expectation of commensurate financial return.

Choice "c" is incorrect. Federal income taxes paid are not a deductible expense.

Choice "d" is incorrect. Charitable contributions are an itemized deduction unless there is an expectation of commensurate financial return. Federal income taxes paid are not a deductible expense.

정답:

Explanation:

Choice "a" is correct. Interest income from U.S. obligations is generally taxable. Interest income on a federal tax refund is taxable, even though the refund itself is not taxed.

Choice "b" is incorrect. Interest income on a federal tax refund is taxable, even though the refund itself is not taxed.

Choice "c" is incorrect. Interest income from U.S. obligations is generally taxable.

Choice "d" is incorrect. Interest income from U.S. obligations is generally taxable. Interest income on a federal tax refund is taxable, even though the refund itself is not taxed.

정답:

Explanation:

Choice "c" is correct. Interest earned on Series EE bonds issued after 1989 may qualify for exclusion. One requirement is that the interest is used to pay tuition and fees for the taxpayer, spouse, or dependent enrolled in higher education. The interest exclusion is reduced by qualified scholarships that are exempt from tax and other nontaxable payments received for educational expenses (other than gifts and inheritances).

정답:

Explanation:

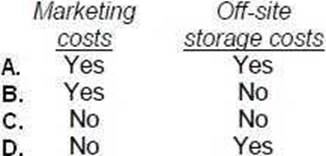

Choice "d" is correct. Under the uniform capitalization rules, purchasers of inventory for resale may deduct their marketing costs but must capitalize their off-site storage costs.

Choices "a", "b", and "c" are incorrect. Marketing costs are deductible, but off-site storage must be capitalized.

정답:

Explanation:

Choice "c" is correct.

I. A payment to a student for a part-time teaching assignment is taxable income just as a payment for any other campus job would be. This is not a scholarship or fellowship.

II. There is no exclusion in the tax law for amounts paid to a degree candidate for participation in university-sponsored research.

정답:

Explanation:

Choice "b" is correct. Cash basis taxpayers deduct interest in the year paid or the year to which the interest relates, whichever is later. Even though all of the interest on this loan was paid on December 1, 1997, only the interest relating to December 1997 can be deducted in 1997. The question does not give an interest rate, but because the loan is to be repaid in a lump sum at maturity, 1/12 of the interest, or $2,000 applies to each month.

Choice "a" is incorrect. Because $2,000 of the interest relates to 1997, this amount is deductible in 1997.

Choice "c" is incorrect. This is the amount that cannot be deducted until 1998, the year to which the interest relates. Be sure to read questions like this very carefully, because if you had simply misread the question as seeking the amount deductible in 1998, you would get the question wrong despite understanding the rule.

Choice "d" is incorrect. Cash basis taxpayers can deduct interest in the year paid or the year to which the interest relates, whichever is later, thus 11 months of the interest will not be deductible until 1998.

정답:

Explanation:

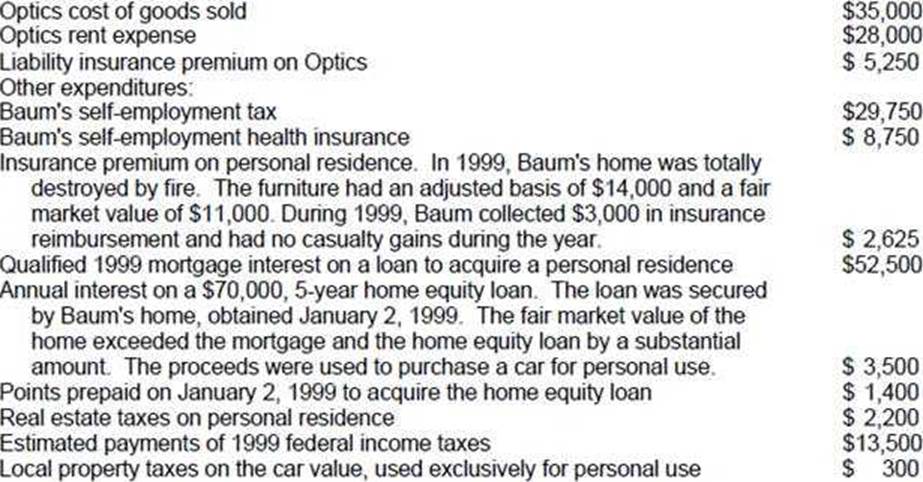

Choice "d" is correct. Baum should report $281,750 as 1999 net earnings from self-employment (line 12 of the Form 1040), calculated as follows:

Choices "a", "b", and "c" are incorrect. Self-employment tax and self-employment health insurance expenses are adjustments from total gross income. They are not deducted from self-employment earnings (i.e., not reported net on line 12 of the Form 1040).

Note: There are many distracters in this question, all relating to items that are either deductible as part of itemized deductions or not deductible. Be careful to read the requirement of the question before spending unnecessary time on the question. The statement that Baum's year-end inventory was not subject to the uniform capitalization rules is a distracter as well. There is not enough information given in the facts to apply the rules if he had been subject to them.

정답:

Explanation:

Choice "c" is correct. Because the second property was personally used more than 14 days, any net loss from the rental of the property will be disallowed.

All related expenses must be prorated between the personal use portion and the rental activity portion.

Prorated depreciation is permitted for the rental activity.

정답:

Explanation:

Choice "d" is correct. An individual receiving common stock for services rendered must recognize the fair market value as ordinary income. Any dividends received on that stock would also result in income recognition.

Choice "a" is incorrect. Employer-provided medical insurance is a tax-free fringe benefit.

Choices "b" and "c" are incorrect. Gifts and inheritances are both tax-free to the recipient. (Remember tax is often paid by the person giving the gift or the estate at death.)